All Categories

Featured

Table of Contents

[/image][=video]

[/video]

Consists of information on costs, qualification, renewability, restrictions and exemptions. Not eligible for non-AARP participants in AK, LA, and OR. The accredited life insurance representative is D. N. Ogle (Arkansas # 17009138, California # 0L37586). The AARP Life Insurance coverage Program is underwritten by New York Life Insurance Policy Firm, New York City, NY 10010 (NAIC # 66915).

New York Life Insurance Firm is licensed in all 50 states. There are various other items readily available under the Program that have various prices, advantage quantities, insurance coverage sizes, underwriting, and various other attributes like persistent illness acceleration.

The Basic Principles Of Coverme ® Guaranteed Issue Life Insurance

AARP has established the AARP Life Insurance coverage Trust to hold team life insurance coverage plans for the advantage of AARP members. Total terms and conditions are established forth in the group plan released by New York Life to the Trustee of the AARP Life Insurance Count On.

Are you looking for assured acceptance life insurance policy without a waiting period? Look no more! Our agency can provide to to nearly anybody that is functioning at least 20 hours a week. If you have actually been declined for insurance previously, this can be your only alternative permanently insurance coverage defense without a waiting period.

The plan additionally offers optional cyclists for spouses and youngsters. You can guarantee your spouse for as much as $30,000 and your kids, aged 26 or younger, for up to $20,000. While no extra needs are required to get approved for this protection, it does raise the price compared to a single-person plan.

See This Report about Term Life Insurance Quotes Without Personal Information

Give us a call today and we'll help you get going. In the table listed below we've given some sample prices by age and sex for $50,000 of ensured concern life insurance policy without a waiting period. If you buy one on these plans, your household or liked ones will be protected as quickly as you make your very first payment.

If these rates don't fit your spending plan, we'll aid you locate the ideal policy for your needs. We can provide just $10,000 or as high as $75,000 of prompt surefire life insurance coverage without any health details. To obtain an accurate quote, click in the type below, or call us toll-free at.

No medical examination is needed for an authorization and the insurance provider will certainly not review your clinical documents. You are assured to be approved. The compromise with ensured life insurance policy plans is that they do not use complete insurance coverage for two-years. This means that if you die from any health-related problem throughout this moment, your family will not obtain the full death benefit from your life insurance policy plan.

No waiting period required. Your policy starts as quickly as you make your initial repayment. Toll-Free: Many life insurance policy suppliers will not supply guaranteed approval life insurance coverage to candidates that under the age of 40. Our agency can use as much as $75,000 of insurance coverage to almost any individual over the age of 18 if they are currently operating at least 20 hours a week.

Find The Right No Medical Exam Life Insurance - Insurdinary Fundamentals Explained

Provide us a telephone call today, toll-free:. Created by: High cliff is a licensed life insurance policy representative and among the owners of JRC Insurance Team. He has aided countless family members of organizations with their life insurance policy requires because 2012 and specializes with applicants that are less than excellent wellness. In his leisure he takes pleasure in spending time with household, taking a trip, and the open airs.

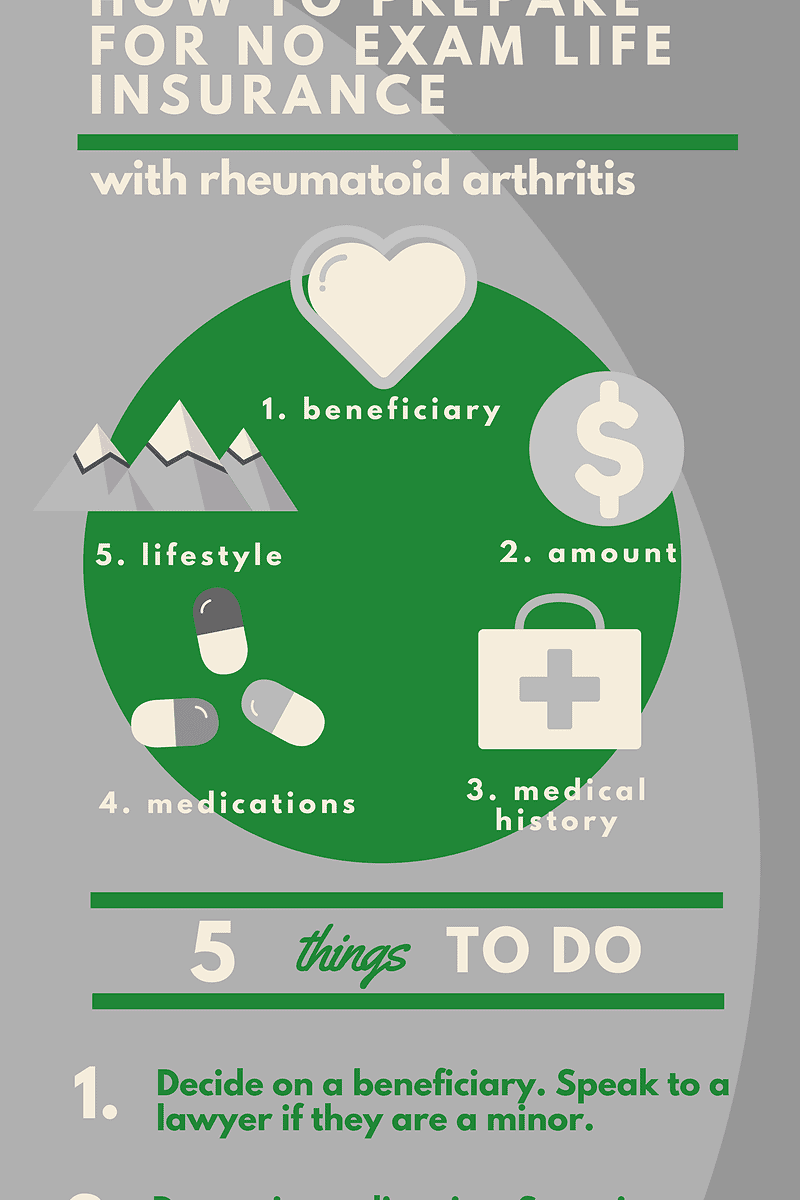

In this post, we'll respond to one of the most regularly asked questions regarding life insurance policy, no medical exam.: No clinical test life insurance policy consists of term and whole life options, with term being extra cost effective and entire life offering long-lasting coverage.: Insurance firms take care of danger in no examination policies by charging greater costs or utilizing different health information sources.

It is very important to note, nevertheless, that the fatality advantage is only payable if the insurance holder passes away within the term. Term life insurance policy is additionally attractive for elders concentrating on long-term preparation. Choosing term life insurance policy without a medical examination can be helpful, especially if you have a clear concept of your protection duration.

Some Of No Exam Life Insurance

Picking whole life insurance policy without a clinical test simplifies the procedure and provides sustaining support. Comprehending the Infinite Financial Concept and Just How It Works In Our Modern Atmosphere 31-page e-book from McFie Insurance Order below > Insurance provider are truly proficient at managing risk. They evaluate health and lifestyle information on each candidate and use this information to identify what amount of costs will be needed in order for the plan to be provided.

Table of Contents

Latest Posts

The 9-Second Trick For What Is No Medical Exam Life Insurance

The 10-Minute Rule for Get Instant Life Insurance Quotes Online For Fast Coverage!

The Best Guide To Get A Free Quote - Aarp Life Insurance From New York Life

More

Latest Posts

The 9-Second Trick For What Is No Medical Exam Life Insurance

The 10-Minute Rule for Get Instant Life Insurance Quotes Online For Fast Coverage!

The Best Guide To Get A Free Quote - Aarp Life Insurance From New York Life